One of the quickest ways to sabotage your own personal finance efforts is to get careless with your money. That sounds like something that should be easily avoidable, but these days it’s easier than ever to spend. We fork over $8 for a subscription here, $100 for a mobile-based investment there, and so on, and that’s to say very little of material and entertainment purchases. Even if you’re generally responsible with your wealth, it’s easy to accidentally let go of more money than you really need to. Because of this, it’s a good idea to look now and then at a few easy strategies for avoiding common financial temptations and risks.

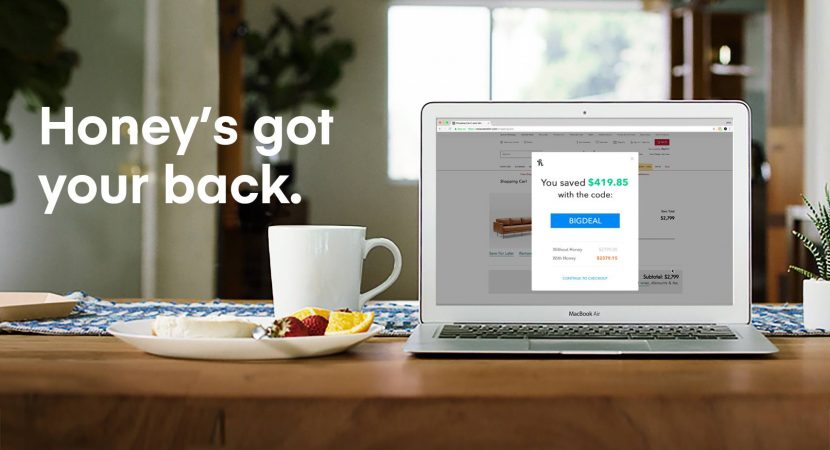

1. Shop With Promo Codes

We all shop online these days, and one of the better ways to spend more than you should be spending is to simply accept listed prices where you see them. Sometimes it’s the only option, to be sure, but shopping around and seeking out promo codes can usually get you a cheaper product or a discount on the product you initially found. And what’s more, you don’t even have to do it yourself. There are now services – most famously one called Honey – that instantly check and apply promo codes online as you shop. It’s a free service, and one that can save you money – and which it simply makes no sense not to use.

2. Wager & Game Cheaply Or For Free

Wagering and real money gaming are arguably more popular than ever, thanks to their availability online and on mobile. These activities – whether playing in a poker tournament or making a bet on a football game – are now essentially mainstream entertainment, and while they can be fun they can also lose you money in a hurry. So instead of getting into them, look for free or cheap versions of them. For wagering, that may mean looking at options like daily fantasy sports where you can play games for $5 or less, or exploring political pick arenas like PredictIt, where you can invest under a dollar at a time. For gaming, you can find free options for a lot of the most popular casino games online, and in some cases mobile casino games work nicely as well (though they can be a little cheesy).

3. Record Your Subscriptions

Most people who regularly use smartphones and computers these days are subscribed to a number of different services. Spotify for music, Netflix and Hulu for video content, various newspapers for journalism, and the list goes on. This is fine to a degree but it also makes it shockingly easy to pay for things you don’t end up using – sometimes for months at a time before you realize it. There are actually ways to check on all your subscriptions so you can make sure you’re not wasting money, but you can also avoid this kind of issue by simply keeping a running notepad or list of the subscriptions you sign up for. Record what it costs, how often you’re going to pay, and what it’s for. That way each time you subscribe to something new and you open up the list you can do a quick check of previous subscriptions and make sure none have become stale expenses.

4. Don’t Invest For Fun

Somewhat like wagering and betting, investing is becoming almost akin to entertainment thanks to mobile devices. Lots of apps now handle investment and make it easy, if not appealing, to buy stocks, invest spare change, or even purchase cryptocurrency. This is all great for people who know what they’re doing. For amateurs however, it’s important not to get sucked in and invest just for fun. That’s a very easy way to get in over your head and end up spending recklessly.