Who doesn’t like to save money? Yet, everywhere we turn, we are inundated with new opportunities to spend our hard earned cash. Advertisements are like a second language to most. Some of us can even sing jingles to popular commercials better than we can remember our mother’s birthday. So, how do escape the constant onslaught of companies’ persuasions to spend, spend, spend when we need to save, save, save? Below are some common sense solutions to this ever present concern.

Be Safe

Many people live their daily lives without stopping to give a great amount to the simple thought of safety. We drive faster than the speed limit, don’t pay attention when working, run at the pool, dive in the shallow end, and eat things out of date. These things might now seem all that major, but if something happens, because you chose not to be safe, you will accomplish the feat of watching your money fly away faster than the speed of light. Not to mention, the pain of recovery. For example, the CDC states that there are at least 9 deaths that are related to distracted driving every year. This does not include the number of injured victims.

Shave The Electric Bill

We all love having the privilege of electricity. The convenience of this one commodity opened the door to so much innovation in technology, alone, but it still costs money. So, make it a point to only use those lights when you need to. Use natural light where you can. Use LED light bulbs. They use a fraction of the power of a standard bulb. Turn the thermostat in the house up a degree or two. This goes for the water heater, as well, in the opposite direction. Better yet, you can upgrade your water heaters with tankless models that heat water simultaneously as it is used, unlike the traditional ones which used to heat up a gallon of water at once, consuming a lot of electricity. Besides, keep your vents open and clean. Finally, you can use white blinds on your windows. In the summer, keep them closed and they will help reflect the sun. In the winter, open them and let the extra heat in.

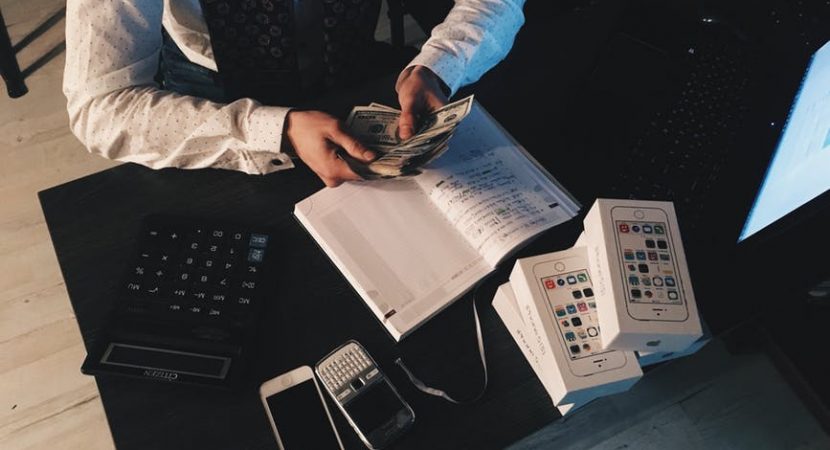

Prevent Impulse Buys

You see that new gadget in the store. You have been wanting it for ages and you just got paid! Of course, you have rent, water, and other bills to pay, but at this moment you need that new gadget! So, you give in and buy it. Your joy is never ending until you get home and figure out you have to juggle your bills, because you don’t have enough money to go around. One way to combat this struggle would be to put your extra cash in a lock box at home so that it’s not on your person when you are out shopping. You could also put it in a savings account. Many have an option to have a waiting period every time you make a withdrawal. This will give you time to reconsider the purchase.

Saving money is a simple concept. In the end, though, it takes will power. We can do this.