There are certain troubles connected to economic bubbles – the troubles concerning mostly investors and market practitioners. Firstly, there’s never a real understanding that you enter one. Secondly, even if you’re smart enough to detect it, how do you know at what point it will become a bust?

Alan Greenspan has once raised the precise question, but in more specific manner, mentioning the Japanese asset bubble trouble.

By the time Greenspan wrote his essay, five years have passed since the accident. Japan’s asset bubble made the stock prices drop by over 60%. The bubble was so ridiculously huge, as, according to The Economist, the value of the land in downtown Tokyo was bigger than the whole California area value.

With the benefit of 20/20 hindsight, it was easy to diagnose that Japan had been experiencing an economic bubble some years earlier. However, the more pertinent challenge, especially for a senior policymaker such as Greenspan, was to spot that, by 1996, US equities were already expensively valued even as they hurtled upwards towards their final bubble peak in 2000.

Greenspan asserted that “a bubble is perceivable only in retrospect”. But at least one academic disagreed. A week before Greenspan had made his 1996 “irrational exuberance” comment, Robert Shiller and a colleague presented research to the Fed, warning that stocks were dangerously overvalued.

Shiller, since a recipient of a Nobel prize in economics, is a model academic. First, he’s very bright. Second, he must be really, really bright because some of his analysis manages to combine academic rigour with startling simplicity. Third, he doesn’t hide in an ivory tower but gets involved in public debate. And finally he’s lucky, in the sense in which Napoleon applied the criterion to his generals.

Consider Shiller’s innovation in developing a measure to determine whether markets are valued expensively or cheaply. The price/earnings (PE) ratio is a conventional measure used by stock market analysts to measure how expensively a stock is valued. But the PE ratio suffers from a key defect. If earnings are cyclically elevated, because we are at the most vigorous stage of the business cycle, then even an elevated price may look reasonable if we use the PE ratio as our guide.

To correct for this danger, Shiller developed the cyclically adjusted price earnings (Cape) ratio. This divides the current price by average earnings over the last 10 years, adjusted for any inflation. By using decade-average earnings rather than last year’s earnings, we avoid the danger of using cyclically elevated or cyclically depressed earnings to estimate value. Instead, we use a through-the-cycle average measure of earnings.

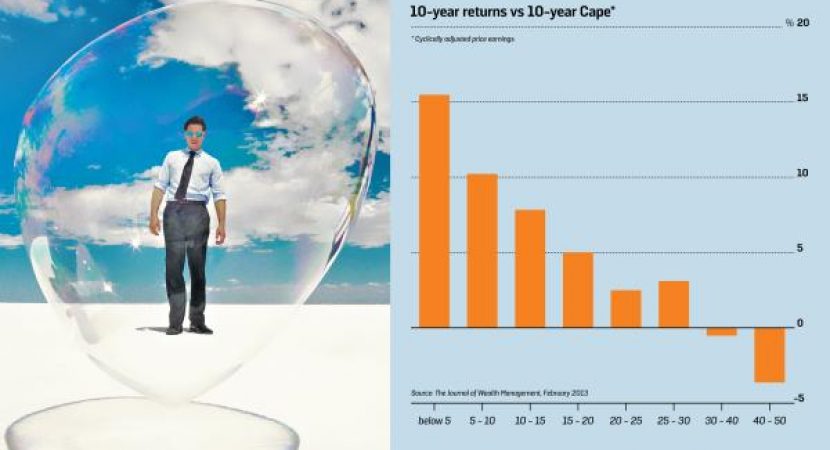

So what, you may ask. Well, there is a strong correlation between the value of a national stock market’s Cape and the subsequent price performance of its stocks over the following decade.

The lower the price you paid for a stock, as measured by its Cape, the higher the returns you would have earned in the US over the years 1881-2011. And the higher the price you paid, the lower the returns.

Imagine, academics have determined that you get better value from a stock if you pay a lower price to buy it.

This finding sounds lame, yet it is profound in its way, for it identifies a value measure which has a strong predictive power regarding future returns.

So what future returns do current Cape measures suggest? Not great, I’m afraid. According to the investment house Star Capital, the US stock market was trading on a Cape of 25.5 at the end of September.

The Irish market was even more expensive, trading on a multiple of 28.2. Those levels suggest meagre — below 5 % a year — stock market returns over the next decade. If you want some cheap stock markets to invest in, consider Russia (Cape of 5.1), China (7), Czech Republic (8.6), Poland (8.9), Turkey (9.5) and Hungary (10.7).

The implication from the US equity market’s high Cape value is that global equity markets are expensively valued. This was supported by the recent Deutsche Bank Long-Term Asset Return Study, which I have written about here before. That report concluded: “Extraordinary central bank buying of assets post the global financial crisis has obviously contributed to high asset prices in recent years.”

The report looked at current equity, bond and property valuations in 15 developed market economies in the context of more than 200 years of data. It found that, in September, equities were in the most expensive 25 percentiles. In other words, in the past two centuries, they have been costlier just a quarter of the time.

The report’s authors concluded bonds were as expensive as they had ever been, and had been cheaper 97% of the time over the past 200 years. Only property appeared to offer some relative value. The authors concluded we are in a bond bubble and bonds are likely therefore to offer negative real returns, after taking account of inflation, in the coming decades. They reckon that equities will outperform bonds — which wouldn’t be difficult if bonds were due to generate negative real returns — but will underperform average historic equity returns.

They add: “There is a genuine risk of a more binary outcome where a major country (countries) sees a hard default on its debt, taking a lot of other debt with it domestically and possibly internationally. This is probably most likely to happen via politics — especially in Europe if a country decides to leave the single currency.”

With Italy voting today on an important referendum, such a possibility cannot be easily dismissed. As the Deutsche Bank report authors cheerily conclude: “A challenging few decades likely await us.”

These decades will be especially challenging for those seeking to generate adequate rates of return on their investments to fund their old age.

PS: Remember your Shakespeare? “There is a tide in the affairs of men, which taken at the flood, leads on to fortune. Omitted, all the voyage of their life is bound in shallows and in miseries. On such a full sea are we now afloat. And we must take the current when it serves, or lose our ventures.”

The Irish economic tide, which has been coming in steadily since 2011, seems to have turned and may be going out again. The year now drawing to a close may yet go down as Ireland’s annus horribilis. Before Italy even begins to count its referendum votes, Ireland has already suffered the triple whammy of the UK voting for Brexit; the European Commission declaring war on our corporation tax policy, with its judgment that Apple owes us €13bn; and, finally, the election of Donald Trump and the threat that, by reducing US corporate taxes, he may negate the appeal of Ireland’s low tax rate.

The Irish Fiscal Advisory Council last week signified that the budgetary tide might also be going out. It warned: “While the Department of Finance’s central projection is for real GDP growth of 3.5% in 2017 and an average of around 3% for the years 2018 to 2021, these growth prospects are far from assured as the Irish economy remains vulnerable to numerous domestic and international risks.

“A GDP growth rate just half a percentage point lower than currently forecast each year would mean the public finances would remain in deficit out to 2021.”

The danger is that Ireland has used its recent budgetary room for manoeuvre to avoid hard political choices in the short term rather than to build our strength for the long term. The political establishment has retreated from a sensible idea — water charges — in the face of substantial protests of dubious merit. And, of the increase in current spending budgeted for 2017, more than 80% will go to public servants and welfare recipients, who are already well paid by any international comparison. And public sector employees are likely to be awarded further pay increases next year after the government agreed to sit down to talks with unions over pay “anomalies”.